Rama Krishna Sangem

Here’s some god news to Finance Minister Nirmala Siitharaman – that more private capital expenditure is likely to come in 2025-26. This is what Confederation of Indian Industry (CII) said. Nearly three-fourths of firms taking part in an industry survey have said that the current economic environment is conducive to private investment.

Interim results of the Confederation of Indian Industry (CII) survey on investment, jobs and wages showed that over 97 per cent of firms were likely to boost employment in FY25 and FY26.

“With the two critical drivers of growth — private investments and employment — looking positive, we feel confident that the overall growth is likely to remain around 6.4-6.7 per cent this year. It may be 7 per cent in FY26,” said Chandrajit Banerjee, director general of CII.

Recent advance growth estimates released by the National Statistics Office (NSO) assumed investment demand, represented by gross fixed capital formation, to grow 6.4 per cent in FY25 — the same as in H1. It signals that private investment is not picking up meaningfully. The advance estimates have estimated India’s GDP to grow by 6.4 per cent in FY25. This is lower than the RBI’s projection of 6.6 per cent and the finance ministry’s expectation of 6.5 per cent growth.

500 firms surveyed

The pan Indian survey of 500 firms across all states, industry sizes — large, medium and small — will be completed by February first week. The interim results are based on a sample of 300 firms. Manufacturing and mining firms made 68 per cent of the sample size. About 90 per cent of the firms surveyed had invested in the last 18 months, in varying amounts.

More than half — 59 per cent of companies — said they would invest in the second half of FY25. And, 70 per cent said they would invest in FY26. “Given that 70 per cent of firms surveyed said they would invest in FY26, an uptick in private investment might be on cards over the next few quarters,” said Banerjee.

Of those planning to increase investments in H2 of FY25, 45 per cent planned to increase their investment in the range of 0-10 per cent. About 39 per cent said they would raise investments by 11-20 per cent. Around 79 per cent firms said they had seen an increase in hiring activity in the last three years in their organisations.

More jobs to come up

While two to three per cent of firms see a decline in employment in FY25 and FY26, the rest expect it to increase in various proportions. Forty-two to 46 per cent of firms indicated a 10 to 20 per cent increase in employment, while about 31 to 36 per cent expect an increase of up to 10 per cent.

The average increase in direct employment due to planned investments in the next one year is expected to be 15-22 per cent for manufacturing and services sectors.

The CII survey said a majority of firms surveyed indicated that it takes between one and six months to fill vacancies at the senior management or supervisory level. Regular and contractual worker jobs take less time to fill in a vacant position. This indicates the need to urgently fill staff vacancies at the higher level in the sample firms.

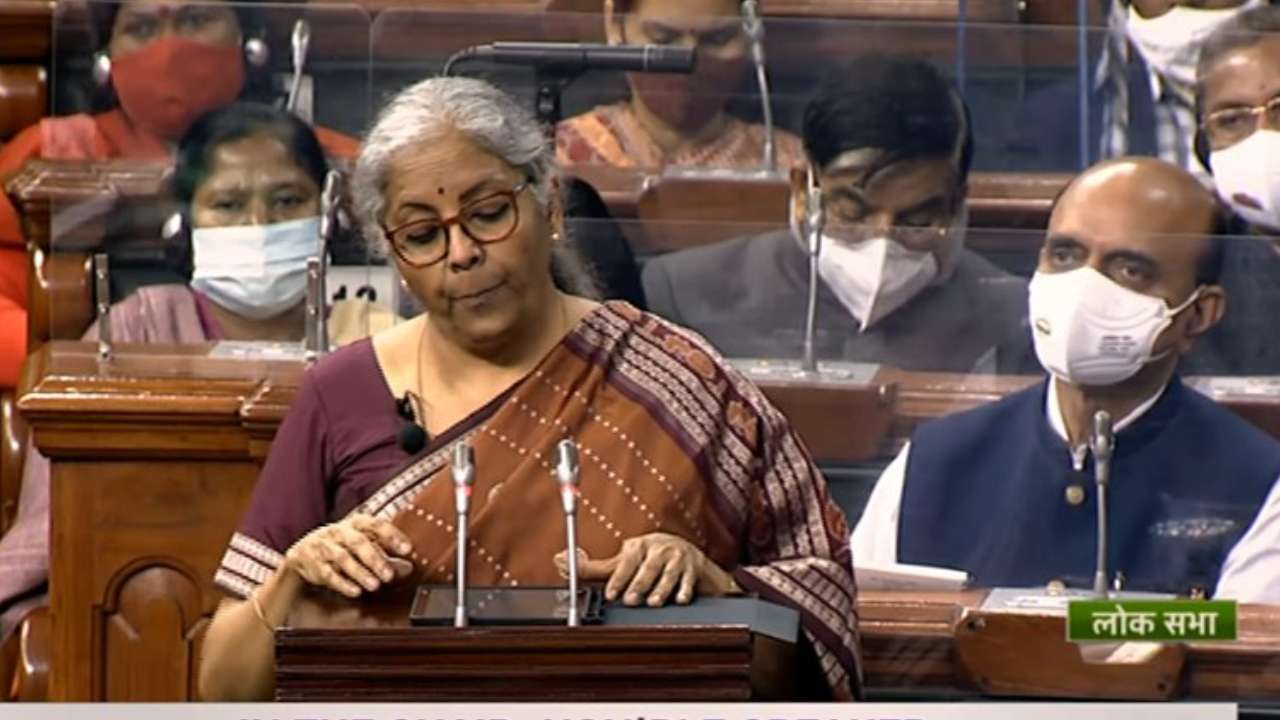

This means, the FM is likely to offer some sops to boost private expenditure in her budget on February 1, Saturday.