Rama Krishna Sangem

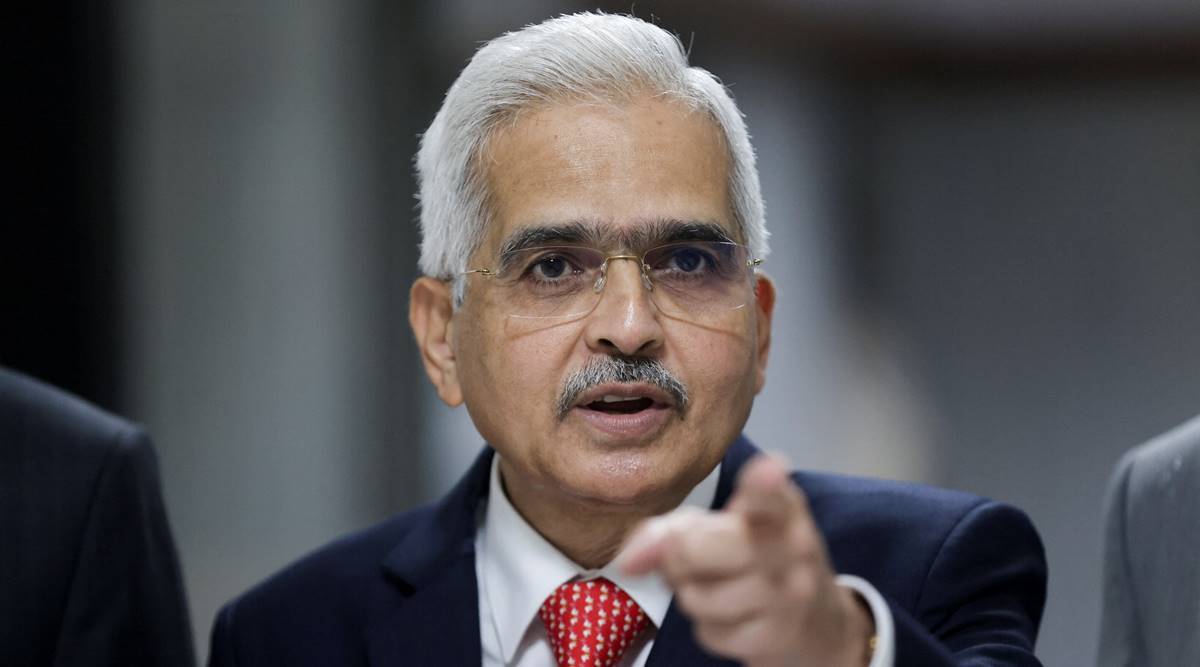

RBI Governor Shaktikanta Das is not a great admirer of disruptive changes in financial technologies – Fintech. While the Indian economy is exhibiting strength and resilience amid global headwinds, the Reserve Bank of India (RBI) is watchful of emerging risks, central bank governor Shaktikanta Das said and cautioned against disruptions in the financial system from new technologies.

Das said the matrix of financial stability is perhaps at its best, but the real challenge is to maintain it and improve upon it further.

“New technologies offer gains in efficiency and customer experience, but they can also bring with them sudden and widespread disruptions to the financial system,” Das said in the foreword of the June edition of the Financial Stability Report, released on June 27 Thursday

“New technologies offer gains in efficiency and customer experience, but they can also bring with them sudden and widespread disruptions to the financial system,” Das said in the foreword of the June edition of the Financial Stability Report, released on Thursday.

RBI watchful of financial hazards

Observing that stress tests showed capital levels of banks and non-banking financial companies (NBFCs) will remain above the regulatory minimum even under severe stress scenarios, Das said even in this stable environment, the regulator is watchful of the emerging risk including those from cyber hazards, climate change and global spillovers.

At a time when the global financial system faces major risks which include alarming levels of public debt, stretched asset valuations, increasing economic and financial fragmentation; and frequent geopolitical conflicts, the Indian economy is exhibiting strength and resilience, with strong macroeconomic fundamentals and buffers, he said.

“Economic activity is expanding at a steady pace, with the financial system being stronger and more vibrant than what it was before the onset of the recent period of crises,” he said.

Das emphasised that it was important to consolidate the gains and nurture a financial system that is future ready and supports the needs of India’s growing economy.

“Furthermore, as India’s contribution to global growth rises, our financial system must also modernise and deepen as it prepares to go more global,” he said.

He said efforts must be made to develop an ecosystem that puts the interests of the customer at the forefront.