Rama Krishna Sangem

Reserve Bank of India may not cut interest rates at least till after February 2025, given the high levels of inflation – which is not around 6.5 per cent, as against the mandatory cut off of 4 per cent.

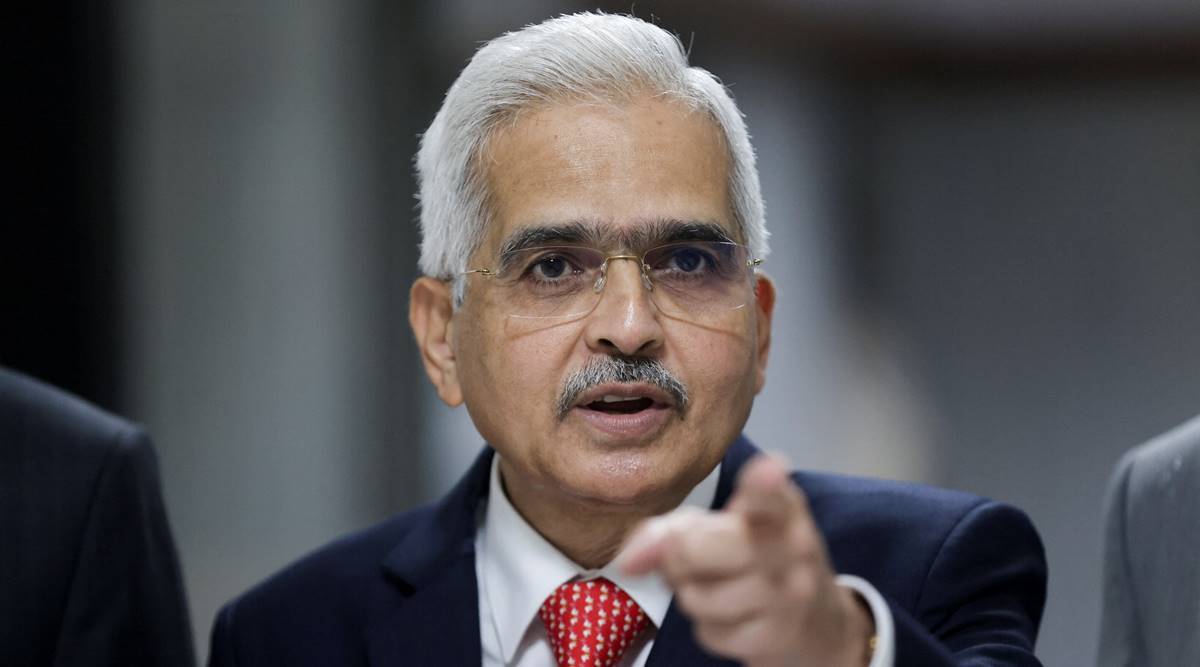

RBI Governor Shaktikanta Das cautioned on Friday that cutting the policy rate at this juncture could be “very premature” and “risky” in light of an uptick in the latest headline inflation reading, something that could persist until the next print, as well.

“Rate cut at this stage will be very premature and can be very, very risky when your inflation is 5.5 per cent and the next print is also expected to be high, you can’t be cutting your rate, more so if your growth is also doing well,” said Das at Bloomberg’s India Credit Forum.

He signalled that the RBI would only consider rate cuts once inflation is durably aligned with the 4 per cent target. “I would not like to speculate on a rate cut in advance. We will need to wait for incoming data,” he emphasised.

Long term view of inflation

The RBI’s policy actions will remain forward-looking, depending on the inflation outlook. “We have to see what is the outlook on inflation for the next six months or one year… (and) based on that we would take action,” Das said.

Earlier this week, RBI Deputy Governor Michael Debabrata Patra indicated that retail inflation may durably align with the 4 per cent target by FY26. Last week, the reconstituted Monetary Policy Committee (MPC) left the repo rate unchanged for the 10th straight meeting, shifting its stance to “neutral”, fuelling speculation of a potential rate cut in December.

On whether the RBI is running the risk of falling behind the curve on rate cuts, Das firmly dismissed the notion, asserting market expectations and RBI policy are well aligned. “Certainly, we are not behind the curve,” he said. Referring to rate cuts by other central banks, Das noted: “We don’t want to join any party… And if we decide to join the party, we would like to join it on a durable basis.”

So, three is no scope of RBI’s Monetary Policy Committee meeting this December cutting interest rats. That means, there will be no flood of money in the market till at least next few months.