Rama Krishna Sangem

Noted economic journalist Swaminathan Aiyar described FM Nirmala Sitharaman’s budget for 2026-27 as ‘unremarkable’, ‘dull’ with continuity. Like him, many other financial experts and economists too expressed their disappointment over the budget which came amidst global uncertainties and troubles. Some of them thought there would be some more tax sops to the common man, so as to boost consumption while others guessed special schemes for Bengal, Tamil Nadu and Kerala which go to polls in 2-3 months.

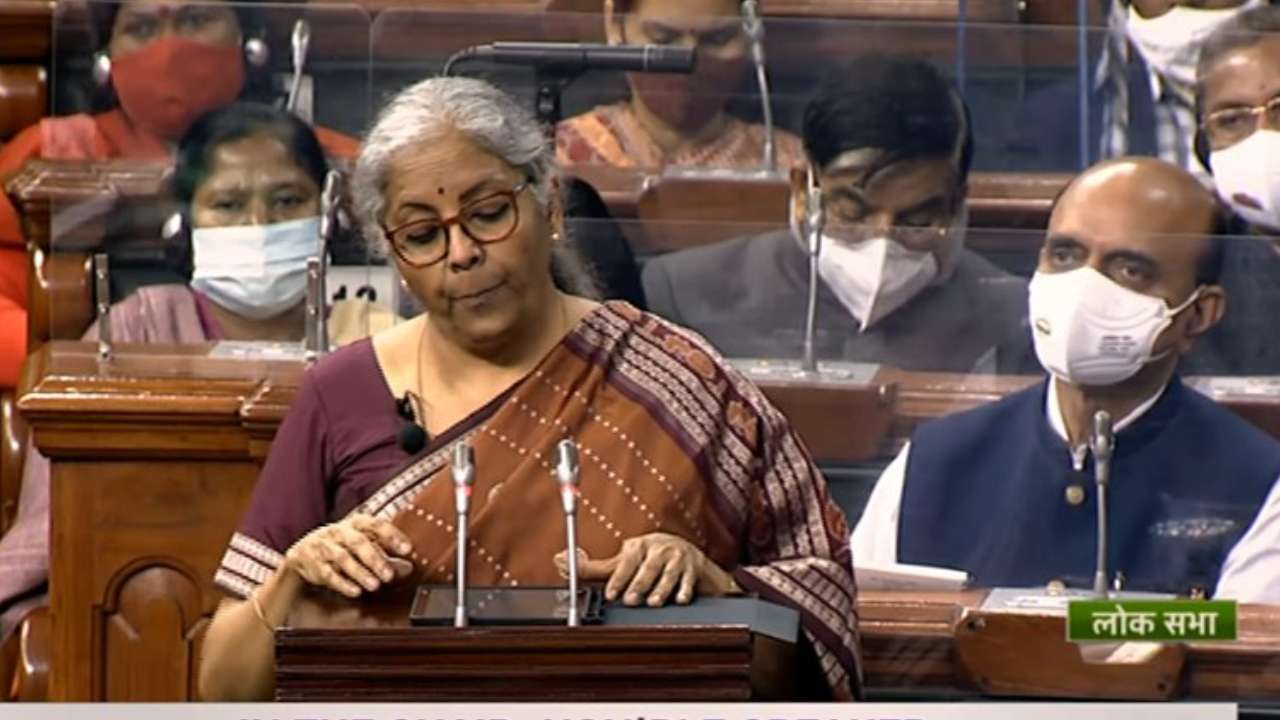

But, neither PM Modi nor Nirmala went for that. They simply chose a regular budget with nominal increases in allocations with some growth path announcements. Slogans like Karthavyas and thrust areas were dished out, as usual in any of Modi government’s last 12 budgets. Close to one and a half hour long speech of FM Nirmala in Lok Sabha looked like a Thali, with one item for every section of public. No one will eat all but everyone will enjoy the plate.

Some Congress MPs explained why there are no special schemes for Tamil Nadu or any other poll bound states. Because, the ruling BJP doesn’t believe they can win any of them confidently, like in Bihar. So, this is a good opportunity to work on basic economics of a simple budget without any pulls and pressures. The government will spend Rs 53.5 lakh crore, around 7 per cent increase over last year figures. Of this, 4.3 per cent is fiscal deficit, means borrowings. Capital expenditure is Rs 122 lakh crore, around 4.4 per cent of the GDP.

All states put together will get Rs 25.43 lakh crore. No basic changes in any income tax slabs.

Some key highlights

Nirmala Sitharaman on February 1, presented the Union Budget 2026 in Parliament, delivering a record ninth consecutive full Budget, and the first on a Sunday. The speech, which ranged from manufacturing and services to skilling, tourism and tax administration, signalled an attempt to align near-term fiscal choices with the longer arc of Viksit Bharat. Here are the main announcements and numbers that framed Sitharaman’s Budget 2026–27 speech:

SME funding and fiscal transfers

The government proposed a ₹10,000 crore SME Growth Fund aimed at backing a new cohort of “future champions”, with incentives linked to pre-defined performance and scaling parameters. Alongside this, the Self-Reliant India Fund, set up in 2021, will receive an additional ₹2,000 crore to extend risk capital support to micro enterprises.

On fiscal transfers, the Centre said it will provide ₹1.4 trillion to states in 2026–27 as 16th Finance Commission grants, which will cover rural and urban local bodies as well as disaster management.

Tax and compliance changes

Several tax and compliance changes have also been announced. The rate for tax collected at source on overseas tour packages will be cut to 2 per cent, down from the existing 5 per cent and 20 per cent slabs, without any threshold condition. Manpower supply services will be explicitly classified under payments to contractors for TDS purposes, attracting a rate of either 1 per cent or 2 per cent to remove ambiguity.

IT, data centres and safe harbour norms

For the IT sector, the safe harbour threshold for services will be raised sharply from ₹300 crore to ₹2,000 crore. A separate safe harbour of 15 per cent on cost was proposed for data centre services provided from India to related entities. Global data centres operating in India will also get a tax holiday through 2047. Non-residents paying tax on a presumptive basis will be exempted from minimum alternate tax (MAT).

Services, labour and care economy

On the labour and services front, Sitharaman announced a high-powered ‘Education to Employment and Enterprise’ standing committee. The panel will focus on policy measures to position the services sector as a central growth engine. A national Care Ecosystem, spanning geriatric and allied services, will also be developed, with plans to train 1.5 lakh caregivers over the next year.

Education, AVGC and creative economy

In education and the creative economy, the Budget proposed support for the Indian Institute of Creative Technologies, Mumbai, to establish AVGC content creator labs in 15,000 secondary schools and 500 colleges. Separately, viability gap funding or capital support will be used to set up one girls’ hostel in every district.

Tourism and cultural infrastructure

Tourism and culture featured prominently in the Budget 2026 speech. The government announced a pilot programme to upskill 10,000 tourist guides across 20 iconic destinations through a standardised 12-week hybrid training module. Fifteen archaeological sites, including Lothal, Dholavira, Rakhigarhi, Adichanallur, Sarnath, Hastinapur and Leh Palace, will be developed as immersive cultural destinations.