Rama Krishna Sangem

Reserve Bank of India (RBI)’s sudden decision on May 4, Wednesday, to hike interest rakes (Repo rate) by 40 basis points (one basis point is one per cent of a rupee) to 4.40 per cent is a clear sign of war on raging inflation. Now the retail inflation stands around 6.95 per cent and it is likely to go higher by June, up to 8 per cent. If this happens, people will find it difficult to buy food and fuel for their daily needs.

The Narendra Modi led BJP government is afraid that this will lead to a situation like that of in 2012-13, when the UPA government faced severe pressure from public and lost the parliament elections in 2014. Modi doesn’t want that to happen. The six member Monetary Policy Committee (MPC) which usually meets once in three months met suddenly on May 4 and increased key rates to tame inflation.

Repo (repurchase agreement) rate is up from 4 per cent to 4.40 per cent while CRR (cash reserve ration) rate is up from 4 per cent to 4.50 per cent. Repo rate is at what RBI lends funds to banks for short time frames, while CRR means the rate at which RBI keeps funds from the banks. So banks, both public and private find it comfortable to park their funds with RBI and lend their monies at higher interest rates to people.

So, this will take out money from the market. An estimated Rs 9 lakh crore will be squeezed out of the circulation from the banks, as loans are no longer cheaper. This shocking news from RBI has shattered the markets. Sensex (Sensitive index of 30 well performing companies stocks of Bombay Stock Exchange) lost 1,000 points, while Nifty (50 well performing companies of National Stock Exchange) suffered 360 points.

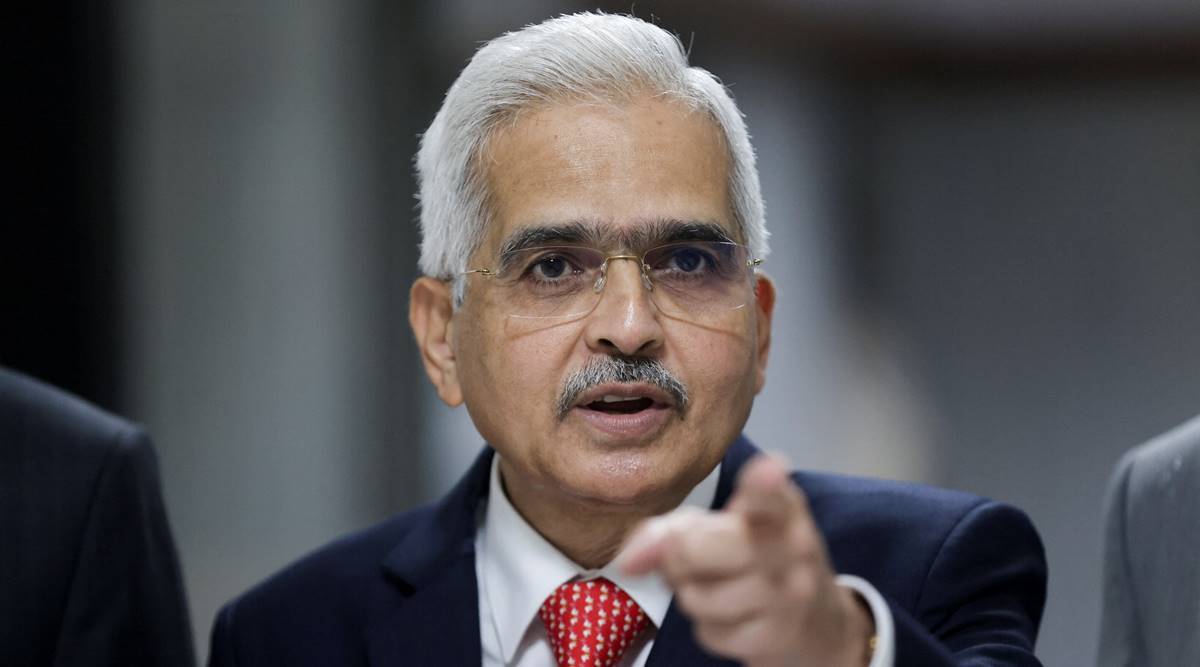

The fall in stock market following RBI’s decision on Wednesday wiped out Rs 6,2o lakh crore wealth of investors. But, RBI thinks this will recover soon. RBI Governor Shaktikanta Das who explained the rate hike decision in an address later, said that the central bank “had taken a calibrated decision taking all factors and possibilities into consideration”. This means the RBI has anticipated this reaction from the markets.

Why this move?

In normal course, the MPC is scheduled to meet in the first week of June. but, it met a month before and hiked the rates. The reason seems to be the growing concerns over the global developments – 1, Russia is unlikely to end its war on Ukraine anytime soon. 2. US Federal Reserve (like our RBI) is meeting on the night of May 4, and is likely to hike interest rates there. 3. China‘s zero Covid policy with more lockdowns, is hitting manufacturing in the country.

Russia war on Ukraine is pushing up prices of petrol and diesel. Now the crude oil price in the global markets is at around 105 US dollars per barrel. At this, we in Hyderabad are paying a pump price of Rs 119 per litre. the global prices appear to go up to 135 US dollars per barrel, by June end. So, our fuel prices will definitely go up by 20 to 25 per cent. No wonder, if we have to pay Rs 130 per litre petrol soon.

But, the higher petrol prices will hurt BJP. Modi doesn’t want to face public anger in Gujarat and other assembly elections which will be held by the year end. This is the reason why the PM has started talking about slashing of taxes on petrol and diesel by states. The Centre has already reduced the excise duty once, last year November. It may cut the excise duty once more, by August-September, if necessary.

It all depends on when Russia will stop its war on Ukraine. If it happens sooner, it will be good, otherwise, the price rise will continue to hit the common man. US Fed has already said it will increase interest rates in the country in the next two years, up to 2 per cent. That will hit the billions of cheap funds from the US which are invested in India now. If that money goes back, our markets will have to struggle for foreign funds. A long term impact on our economy.

For now, RBI thinks India is on safe side. With around 650 billions of US dollars in foreign reserves, we can face any situation, Das said. Governor Das is optimistic about easing situation in China, ending of Russian war and buoyant performance by Indian economy. So, that pressures of inflation would ease by the year end. If that happens, there may not be back to back interest rate hikes.

Till then, we have to put with limited money in the markets and costly loans and higher EMIs from the banks.